33 Roundup of Student Loan Debt Statistics

Student loans weigh heavily on consumers. These statistics make it clear. Student loan debt is an ongoing concern.

Average Student Loan Debt in the United States

- At the end of 2024, Americans owed $1.6 trillion in federal student loan debt.

- 43 million Americans have student loans.

- Borrowers over the age of 24 owe $14,000 in federal student loan debt. That’s according to the National Consumer Law Center (NCLC).

- Borrowers over the age of 62 have an average of over $43,000 in federal student loans.

Average Student Loan Debt by State

- By state, the following chart demonstrates student loan debt:

|

Average Student Loan Debt by State |

|

|

State |

Debt per Student |

|

Alabama |

$37,709 |

|

Alaska |

$35,821 |

|

Arizona |

$35,675 |

|

Arkansas |

$33,858 |

|

California |

$38,168 |

|

Colorado |

$37,392 |

|

Connecticut |

$36,672 |

|

Delaware |

$38,683 |

|

District of Columbia |

$54,795 |

|

Florida |

$39,262 |

|

Georgia |

$42,026 |

|

Hawaii |

$38,158 |

|

Idaho |

$33,281 |

|

Illinois |

$39,055 |

|

Indiana |

$33,243 |

|

Iowa |

$30,925 |

|

Kansas |

$33,119 |

|

Kentucky |

$33,470 |

|

Louisiana |

$34,866 |

|

Maine |

$34,292 |

|

Maryland |

$43,692 |

|

Massachusetts |

$35,529 |

|

Michigan |

$36,974 |

|

Minnesota |

$34,071 |

|

Mississippi |

$37,254 |

|

Missouri |

$35,675 |

|

Montana |

$33,945 |

|

Nebraska |

$32,377 |

|

Nevada |

$34,589 |

|

New Hampshire |

$34,884 |

|

New Jersey |

$37,201 |

|

New Mexico |

$34,280 |

|

New York |

$38,690 |

|

North Carolina |

$38,695 |

|

North Dakota |

$29,647 |

|

Ohio |

$35,033 |

|

Oklahoma |

$32,103 |

|

Oregon |

$37,829 |

|

Pennsylvania |

$36,267 |

|

Puerto Rico |

$31,022 |

|

Rhode Island |

$33,270 |

|

South Carolina |

$38,770 |

|

South Dakota |

$30,928 |

|

Tennessee |

$36,886 |

|

Texas |

$33,581 |

|

Utah |

$33,746 |

|

Vermont |

$38,404 |

|

Virginia |

$40,137 |

|

Washington |

$36,762 |

|

West Virginia |

$32,358 |

|

Wisconsin |

$32,628 |

|

Wyoming |

$31,503 |

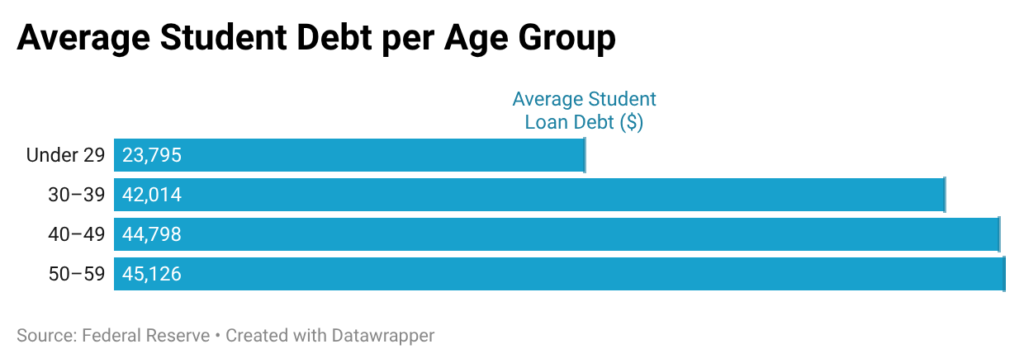

Average Student Loan Debt by Age

- People under the age of 29, have an average of $23,795

- People between 30 and 39 years of age: $42,014 in average student loan debt

- People between 40 and 49 years of age: $44,798 in average student loan debt

- People between 50 and 59 years of age: $45,126 in average student loan debt

- Since 2017, federal debt among people over the age of 62 has grown by 33.2%.

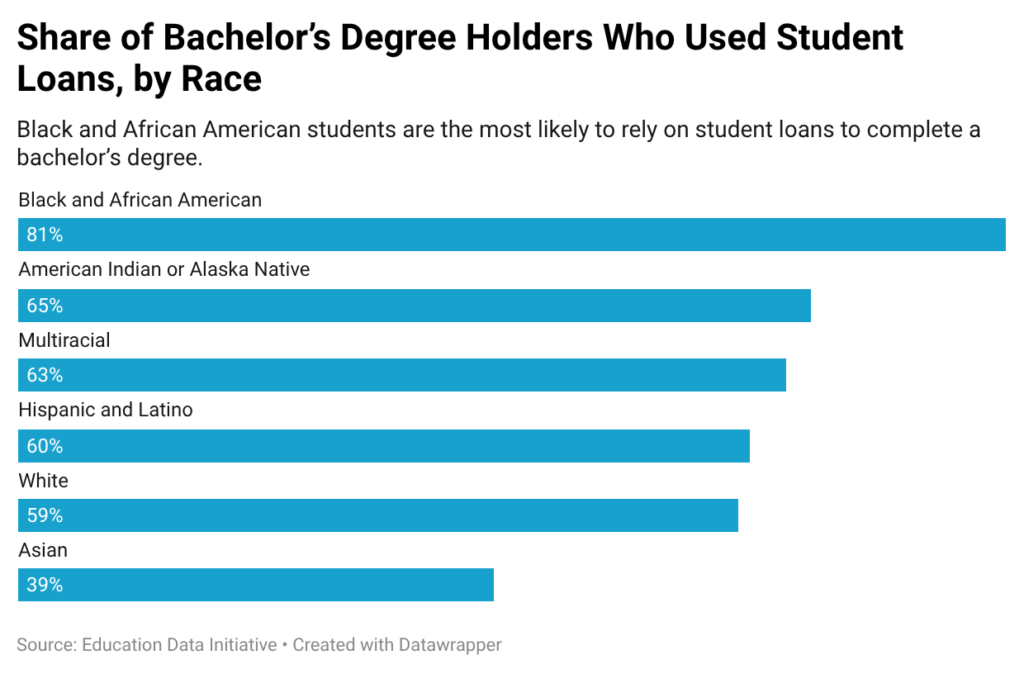

Average Student Loan Debt by Race and Gender

According to the Education Data Initiative, the following races have used student loans to acquire a bachelor’s degree.

- Whites: 59% of students had student loans

- Black and African Americans: 81% have student loans

- Hispanic and Latino: 60% have student loans

- Asian: 39% have student loans

- American Indian or Alaskan native: 65% have student loans

- Multiracial: 63% have student loans

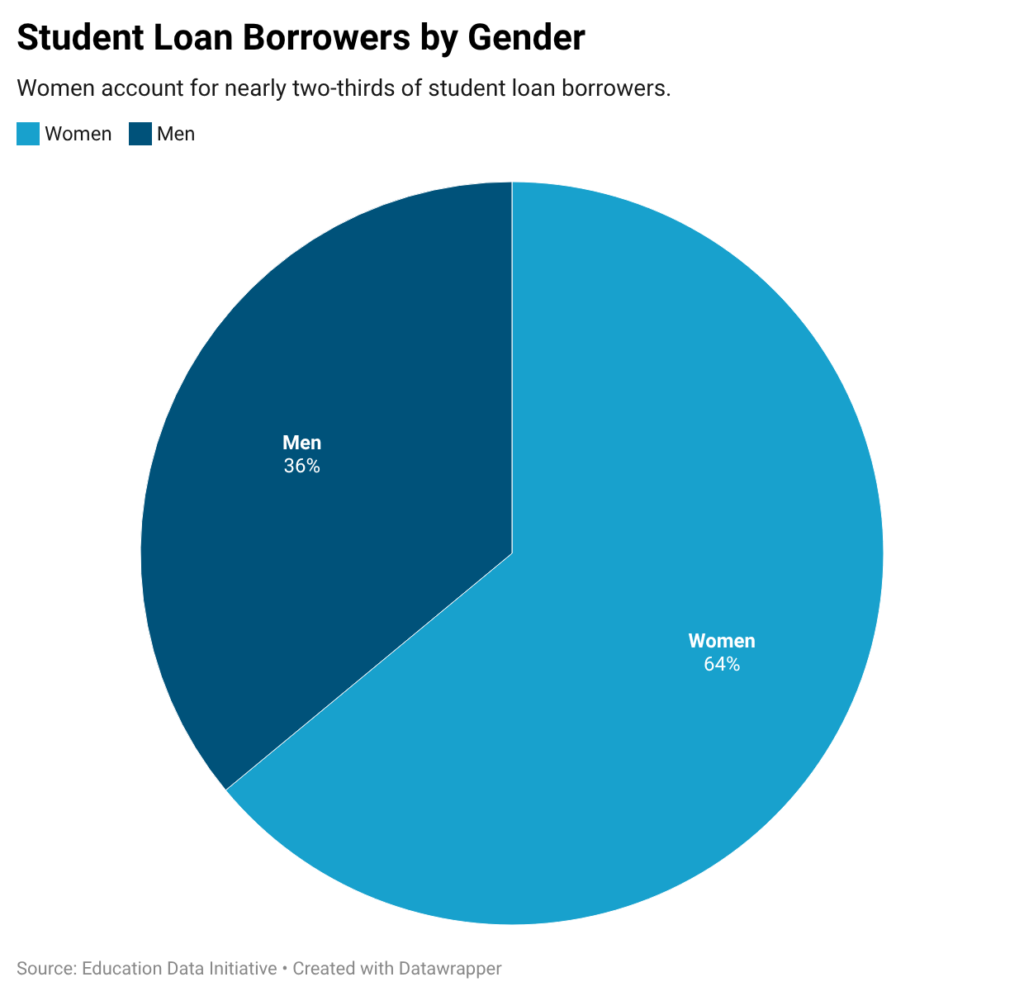

According to this report from Education Data Initiative, the following is how loans are spread by gender:

- Women: 64%

- Men: 36%

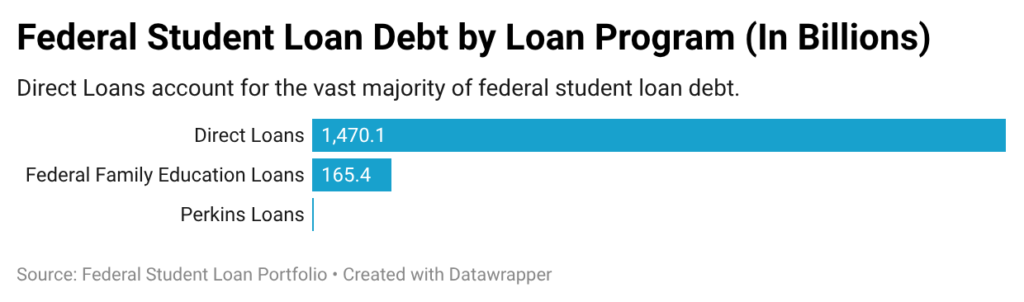

Federal Student Loan Portfolio

This data provides a look at the portfolio of student loan debt through the end of 2024. This figure represents billions. It’s from the Federal Student Aid site.

- Direct loans: $1470.1 billion in loans for 38.2 million people

- Federal Family Education Loans: $165.4 billion in loans for 7.3 million people

- Perkins Loans: $3.1 billion in loans for 1 million people

- Total: $1,638.6 billion for 42.7 million people

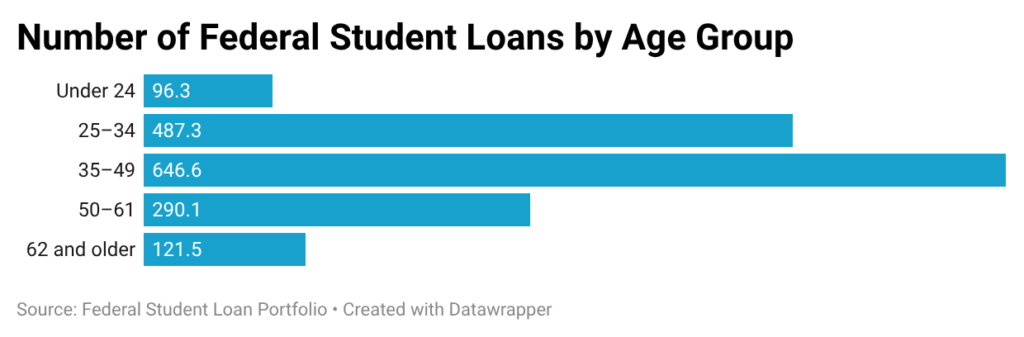

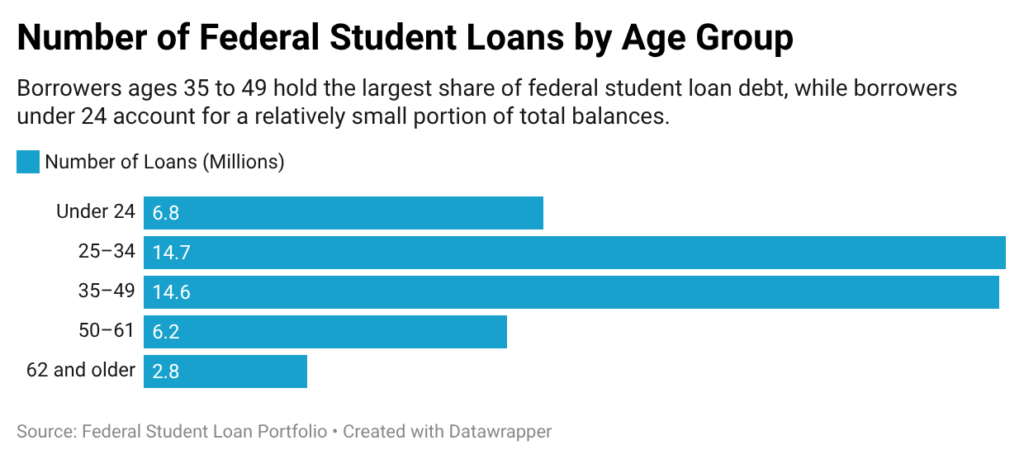

Federal Student Loans by Age

From the Federal Student Loan Portfolio, representing billions of dollars:

- Under 24: $96.3 in 6.8 million loans

- 25 to 34: $487.3 in 14.7 million loans

- 35 to 49: $646.6 in 14.6 million loans

- 50 to 61$290.10 in 6.2 million loans

- 62 and older: :$121.5 in 2.8 million loans

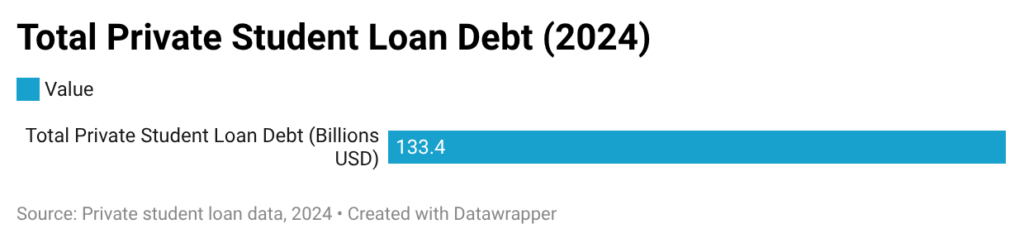

Private Student Loan Portfolio

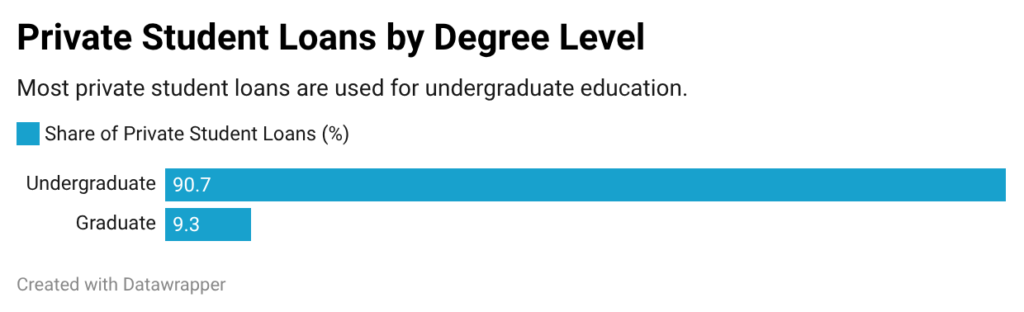

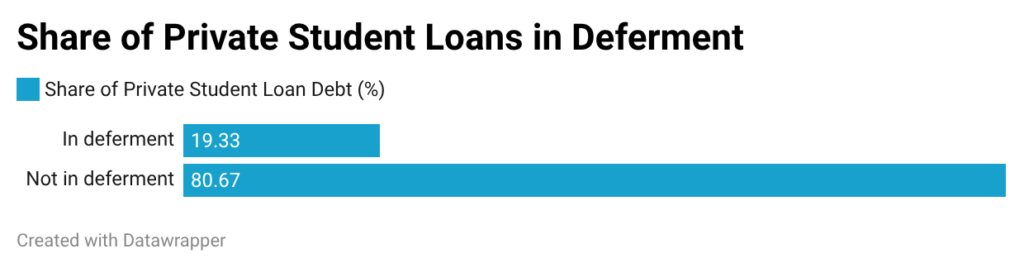

In private student loans, check out these factors:

- $133.4 billion in private student loans at the start of 2024

- 90.70% of private student loans are for undergrads

- 9.3% of private loans are for graduate degrees

- 19.33% of private student debt was in deferment

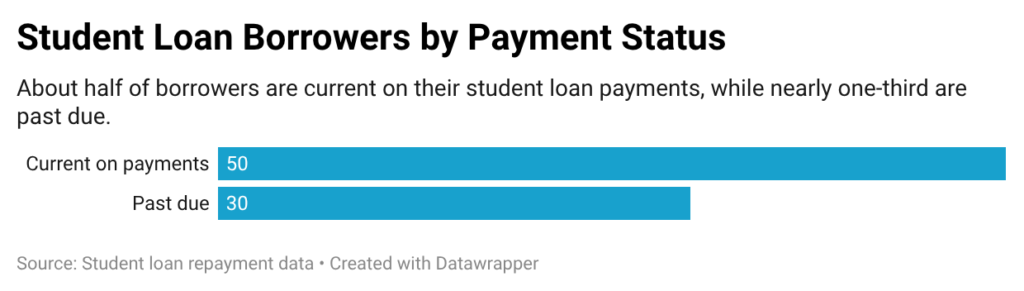

Student Loan Repayment Statistics

- Approximately 50% of borrowers are current on payments

- Approximately 30% of borrowers were past due

Student Loan Forgiveness

Under the Biden Administration, over 5 million borrowers saw their debt cleared. That was under the Public Service Loan Forgiveness program.

President Joe Biden announced debt forgiveness of 150,000 borrowers in the final days of his time in office. That resulted in clearing the debt for 85,000 people who reported being cheated and defrauded by their school.